把你也放了吧,以后我要问你炒股的事,可要好好告诉我呀。

1235678 发表于 2012-4-12 11:19

Quote from ScalperJoe:

Got it, thanks. However, I'm curious as to how you get the 960 target, and what is the scenario for it to occur this year?

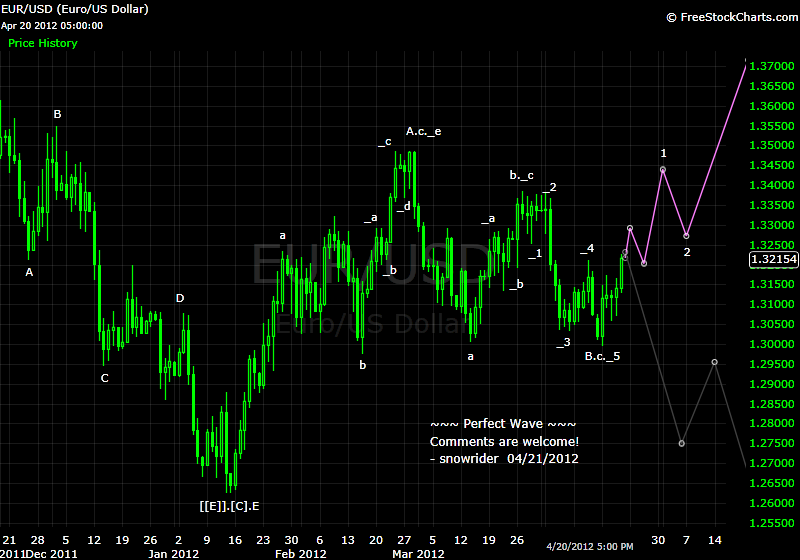

If it breaks 1,320 then perhaps it goes flatline to around 1,250-1,290 range during mid-summer (near mid-point of 5 wave pattern which began last October), before closing out in the black for 2012.

Without some climactic event (war, lack of additional QE, hyperinflation, Euro/dollar collapse, etc), I'm not sure the market is poised break the prior two years of intrayear lows and to fall to 960. I'm not suggesting it won't retrace on the larger wave count eventually, just not by the end of this year.

Your thoughts, comments?

Quote from toc:

Snowrider,

given that you have been doing the EW for sometime now, what percentage of your calls prove to be good. have never been into EW although use Fib retracements etc. at times.

Quote from ScalperJoe:

snowrider,

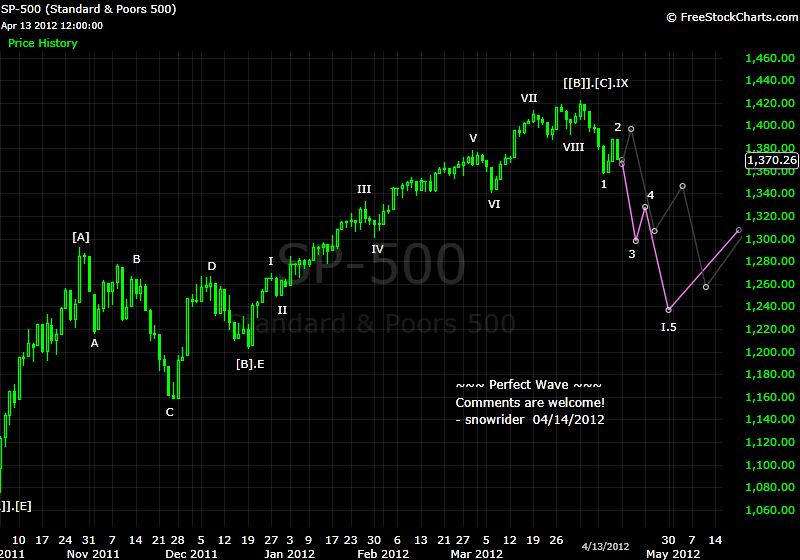

Given the recent swings in SPX, is it safe to interpret the past five down bars as "A" and today's snap back rally as "B" of Wave 4, which may last a few more days, followed by a "C" wave back down? The way I read the current pattern, the SPX falls below its current 50 day moving average of 1,370 again, thus completing the A-B-C pattern in Wave 4.

However, I find the difficulty in EW analysis is in attempting to pinpoint the accuracy of when Wave 4 ends and when Wave 5 begins, until of course after the fact!

snowrider,

the count of the "thewavetrading" since the oct. 2011 low for the S&P is more logic for me than yours:

Sixer

Quote from EliteThink:

[B]the odds of that occuring in an election year for the spx are low. 1325-1340 should be solid support. [/B]

are you bullish on SPY for mid-term since you are holding UPRO

Quote from Wide Tailz:

So we all anticipate the SP500 coming down from the bear flag. This consensus makes me nervous... traders rarely agree!

谢谢雪骑老大!那么牛啊,啥时候到3600啊?另外,在那里可以看到老大如果更新A股的图呢?

那雪骑觉得国债和股市的关系呢? 他们之间的反向关联呢?

Quote from Wide Tailz:

That looks very logical. Chop like this makes me so angry some days!

Perhaps I can see a hypnotist to get me to stop trading during corrective waves. They are unpredictable.

Quote from ammo:

post bank intervention it's much easier to manipulate ,no bear stearns to pick off the whales,eom and expo seem to always work upward,snow,thanks for putting this out there

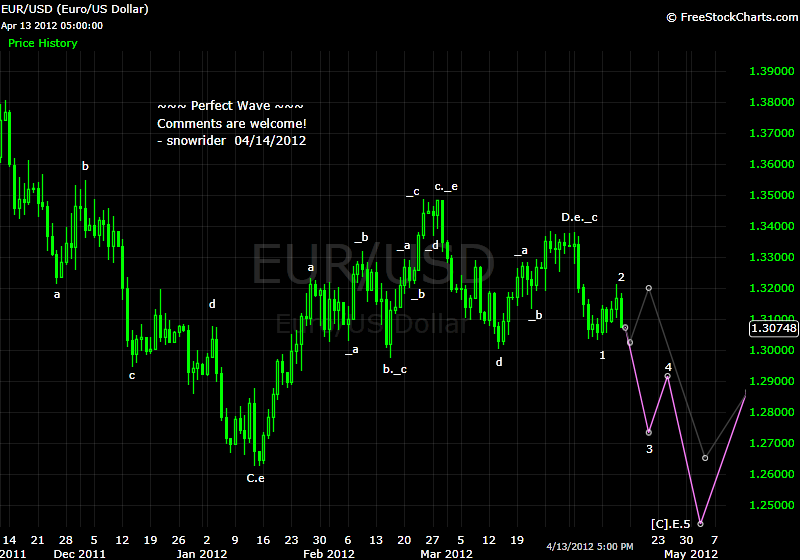

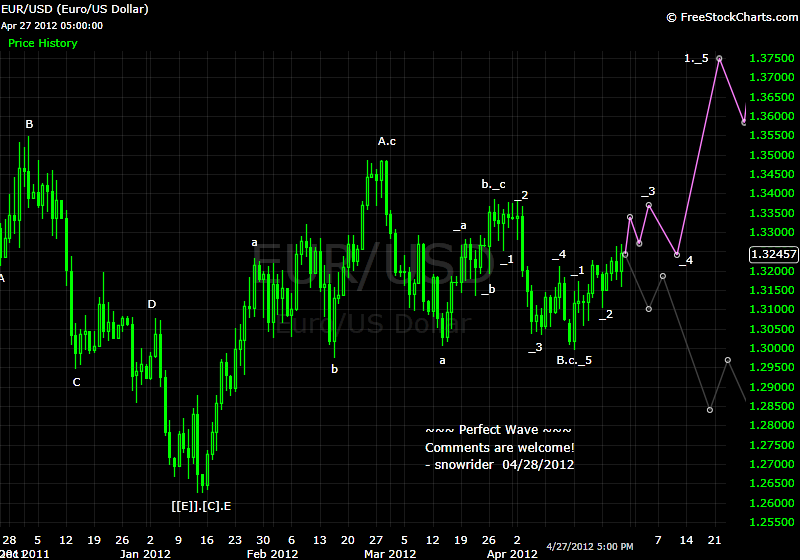

i hope you did take the easy long on EU 27 april at 1.3178 it was the obvious one for 75 pips

你很确定sp下一步要大跌啊

... 不过也是, 再上的话, 新高的可能性很大. 看DOW现在样子, 不拔高不甘心啊.

昨天gdp调整都没有撼动MM的牛心,没招了

Quote from ScalperJoe:

[B]Just so I understand this correctly, as this is very interesting regarding the wave count, if the futures (/ES) breached but SPX did not, which takes precedence in accurately counting the waves? [/B]

Quote from ScalperJoe:

Ok, so if the March low of 1,340 holds then I agree with scenario 1 that the market would rally as a wave [V] for a retest of the highs.

If it doesn't, then one target for scenario 2 downtrend is the next fib level of the bigger 5 wave pattern, which happens to correspond very closely with the Wave 1 top of around 1,293.

Given that the 100day moving average and two large daily tails offer support on the SPX chart, it seems more likely that your scenario 1 will prevail. These corrective wave patterns are quite tricky, and definitely have more headfakes than the clearer Wave 3 pattern.

today u said wave3-4 have finished.

how do you judge wave3-4 finish, by 30min macd crossing down?

could it be possible to have ABC, i.e. 1st leg SPX 1295 to 1328, then down to 1315, then tomorrow 2nd leg up to ~1340? thanks!

hq1888 发表于 2012-5-22 22:12

| 欢迎光临 华人论坛 (http://ftp.yayabay.com/forum/) | Powered by Discuz! 7.2 |